|

Welcome to our deep dive into the world of trust funds! You're in the right place to learn about managing your money and planning for the future. You're also in the right place if you want to understand trust funds. This blog sheds light on trust funds, an often misunderstood but crucial part of financial and estate planning.

What You Will Learn

In this comprehensive guide, we'll explore the definition of a trust fund, its various components, and how it operates. We delve into different types of trust funds and their advantages and disadvantages. Trust funds can be an integral part of your financial strategy. If you're just starting to think about your financial future, this guide equips you with the knowledge to make informed decisions about trust funds.

Understanding Trust Funds

A trust fund, at its core, is a legal entity that holds assets for the benefit of another person, group, or organization. They're similar to a safety deposit box where you keep valuables. In this case, the valuables can be money, property, stocks, or even art.

The Three Pillars of a Trust Fund

- The Grantor: This is the person who creates and funds the trust. They decide what is deposited into the trust, set the rules, and can sometimes alter the trust during their lifetime.

- The Beneficiary: The individual or group for whom the trust is set up. They receive benefits from the trust, such as income, and the right to use certain properties or other assets.

- The Trustee: They are the guardians of the trust, holding legal title to its assets. Their role is to manage the trust based on the grantor's instructions, and carry out the terms of the trust according to the grantor's intent.

Setting Up a Trust Fund

Creating a trust involves executing a legal document known as a trust agreement. This outlines the details of the trust: who the beneficiaries are, the duties of the trustee, and when and how the trust ends.

What Does Funding a Trust Mean?

You can place a wide variety of assets into a trust fund. The assets you choose depend on your goals. Income-generating assets like bonds for income, or perhaps a life insurance policy to provide for your family after your death are examples.

Advantages of Trust Funds

- Tax Benefits: They can help reduce estate taxes.

- Asset Protection: Trusts can shield assets from creditors.

- Avoid Probate: This means faster and private transfer of assets to your heirs.

- Control Over Assets: You can specify how and when your assets are distributed.

- Professional Management: Trusts can be managed by experienced professionals.

Disadvantages of Trust Funds

- Costs: Setting up and maintaining a trust can be expensive.

- Loss of Control: Some trusts mean giving up control over your assets.

- Time and Compliance: Maintaining a trust requires time and adhering to legal requirements.

- Tax Implications: Trusts can sometimes face higher income tax rates.

Types of Trust Funds

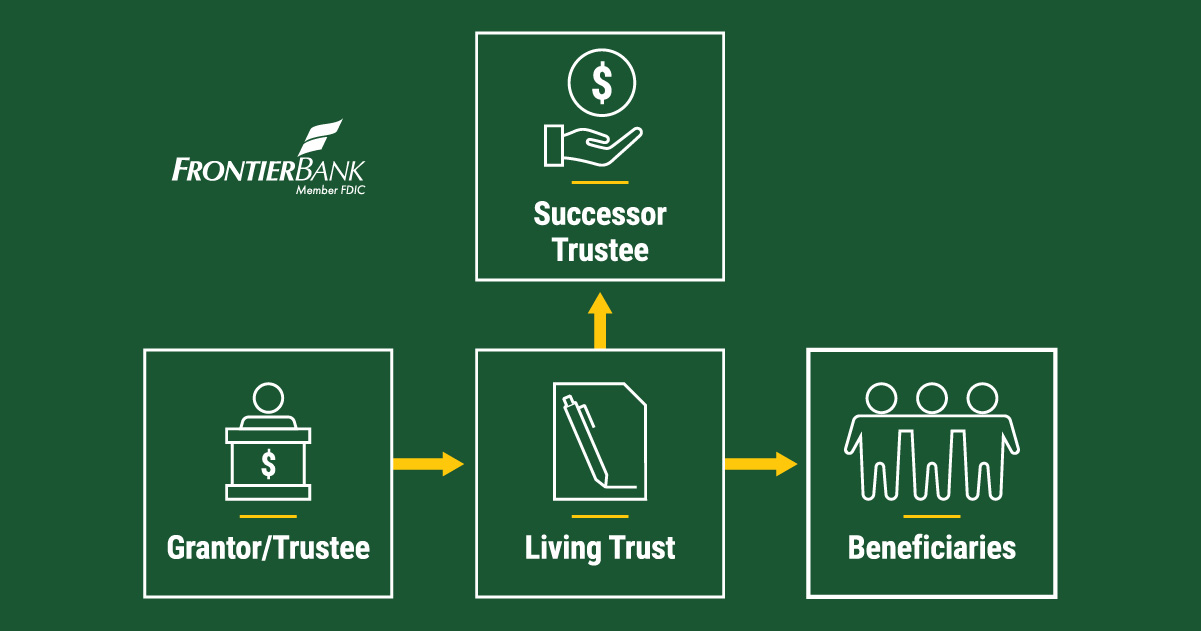

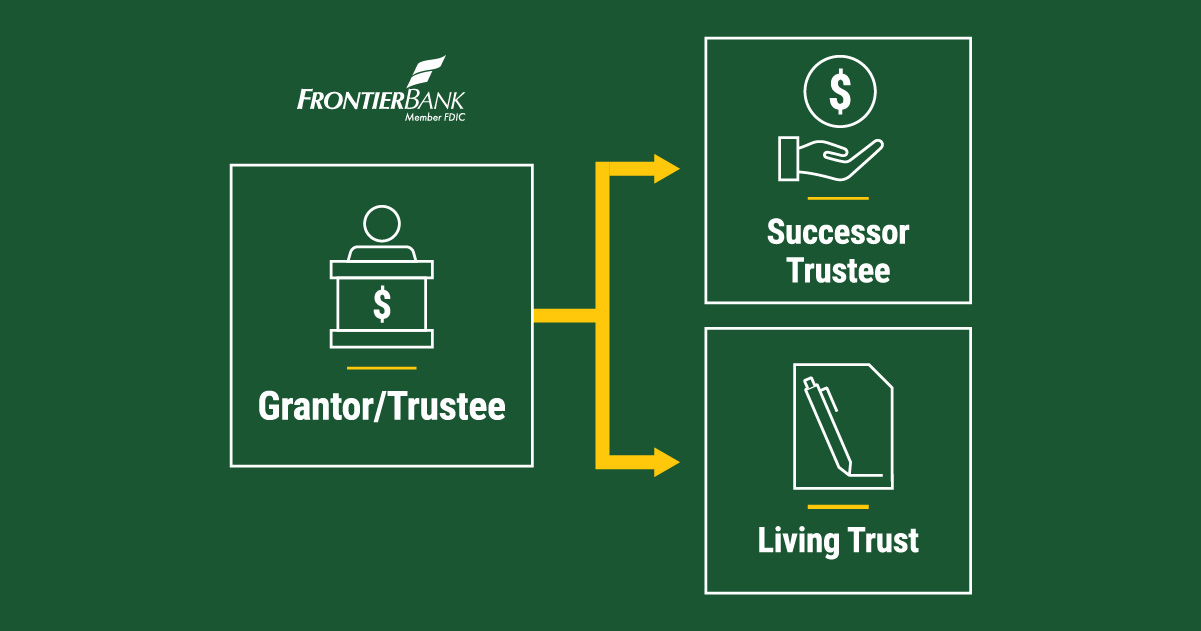

Revocable Trusts (Living Trusts)

- Flexibility: You can alter this trust as your circumstances change.

- Avoid Probate: Assets in a living trust skip the probate process.

- Incapacity Planning: A successor trustee can manage the trust if you're unable to.

Irrevocable Trusts

- Estate Tax Benefits: Can reduce potential estate taxes.

- Fixed Terms: Once set, these trusts are usually unchangeable.

- Protection from Creditors: Often shields assets from future creditors.

Trust funds, whether revocable or irrevocable, offer a range of benefits. They can be a powerful tool in your financial and estate planning arsenal. It's important to understand the basics and work with experienced professionals. Professionals like David Cover, Brad Lupkes, or Taylor Bonestroo can ensure that your trust fund aligns with your personal goals and provides for your beneficiaries as intended.

If you're ready to explore how a trust fund can fit into your financial plan, or if you have more questions, don't hesitate to reach out to Frontier Bank. Our team of experts is here to guide you through every step of your trust fund journey. Let's unlock the potential of your financial future together!

Source:

Broadridge Financial Solutions

David Cover, AIF®

Chief of Wealth Management & Trust Officer

trust@frontierbank.com

|