Summary:

A revocable living trust can be a useful and practical estate planning tool for certain individuals, but not for everyone. This type of trust is most commonly used to avoid probate because, unlike property that passes by will, trust assets are distributed directly to heirs. This type of trust is also used as a way to maintain management of one's financial affairs during a period of incapacity because someone else can immediately take charge when needed. A revocable living trust does not minimize income, gift, or estate taxes, nor does it shelter trust assets from creditors in most cases.

What is a revocable living trust?

A revocable living trust (also known as an inter vivos trust) is a separate legal entity created to own property, such as a home or investments.

The trust is revocable, which means that during the grantor's lifetime (the grantor is the person who originally owns the property and creates the trust), he or she controls the trust. Whenever the grantor wishes, he or she can change the trust terms, transfer property in and out of the trust, or end the trust altogether.

The trust is called a living trust because it's meant to function while the grantor is alive. The trust can continue after the grantor's death, but the trust becomes irrevocable the moment the grantor dies.

Revocable living trusts are used to accomplish various purposes:

- To ensure that property continues to be properly managed in the event the grantor becomes incapacitated

- To reduce costs and time delays by avoiding probate

- To lessen potential challenges to or elections against a will

- To maintain privacy

- To avoid ancillary administration of out-of-state assets

How does a living trust work?

Establishing the trust

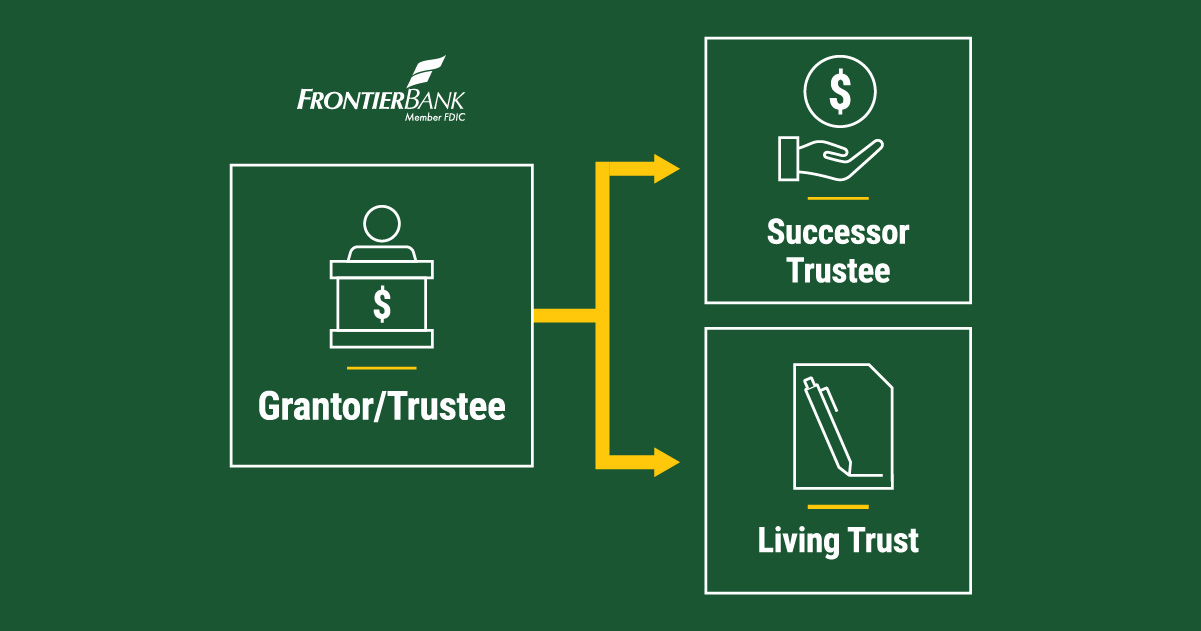

Typically, an individual creates and funds the trust, and names himself or herself as both the trustee and sole beneficiary for his or her lifetime (if married, both spouses are typically named beneficiaries). The grantor also names a successor trustee or co-trustee, as well as the beneficiaries who will receive any assets that remain in the trust at the grantor's death. Often, a spouse or child is named as the successor or co-trustee and is also named as an ultimate beneficiary.

Caution: In some states, a co-trustee is required.

The grantor continues to manage trust assets during his or her life. Any income earned or expenses incurred by the trust flow through to the grantor on the grantor's individual income tax return. A separate return for the trust is not necessary.

In the event the grantor becomes incapacitated (e.g., from illness or injury), the successor trustee or co-trustee can immediately step in to take over the management of the trust on the grantor's behalf, avoiding the need for the grantor's spouse or other family members to petition the court to appoint a guardian.

Tip: If special knowledge or skill is required to manage property in the trust, the successor or co-trustee should be qualified.

At the grantor's death, assets remaining in the trust pass directly to the beneficiaries, bypassing the probate process. This can save time and money, and can minimize some of the burden of settling the grantor's estate.

Funding the trust

To ensure that the trust fulfills its objectives, the trust must be funded after it is created. Funding the trust means transferring legal title from the grantor into the name of the trust. This may entail recording a new deed for real estate; re-titling cars and trucks; renaming checking, savings, and investment portfolio accounts; transferring life insurance policies, stocks, and bonds; executing new beneficiary designation forms; or executing assignments.

Although a revocable living trust can be funded with virtually any kind of property, including personal property, special consideration should be made before transferring certain types of property, including:

- Incentive stock options

- Section 1244 stock

- Professional corporations

Tip: Transfers to the trust are not considered gifts, so the grantor doesn't need to file a gift tax return.

Caution: Some states will reassess the value of a home for property tax purposes when it is transferred to a trust. Some states will disallow income tax deductions related to the home if it is owned by a trust.

Caution: Some banks may impose a penalty when certificates of deposits (CDs) are transferred to a trust because they consider such transfers to be early withdrawals.

Suitable clients

A revocable living trust can be appropriate for individuals:

- Owning real estate in more than one state (to avoid ancillary probate)

- With concerns about their health or future ability to manage their own financial affairs

- Who want to keep transfers at death private (to avoid family conflicts, for example)

- Who want someone else to manage and invest assets (e.g., persons with special needs, persons who often travel overseas)

- Who want someone with special knowledge or skill to manage and invest assets (e.g, persons who inherit or win large sums of money)

- Who are single or who care for themselves

- Who are unmarried domestic partners

- Who are elderly or ill

- Who are not concerned about transfer taxes

Example

Harry and Wilma just celebrated their golden wedding anniversary. They have a 49-year-old daughter, Cindy, who is a professor at the community college, and a 47-year-old son, Carl, who is an engineer. Harry's health is beginning to fail, and lately, he's had a little trouble remembering things. Harry has always taken care of the family finances, and he's worried that Wilma might not be able to manage them on her own if something should happen to him. Harry and Wilma own the following assets jointly:

|

Home

|

$600,000 |

|

Checking and Savings Accounts

|

$2,000 |

|

Certificates of Deposit (CDs)

|

$20,000 |

|

Bonds

|

$7,000 |

|

Mutual Funds

|

$5,500 |

|

Life Insurance

|

$1,000,000 |

|

Total

|

$1,634,500 |

Harry and Wilma aren't worried about federal transfer taxes because their estates ($817,250 each) will be sheltered by their exclusions ($13,610,000 per individual in 2024, $12,920,000 per individual in 2023).

So, Harry and Wilma transfer all of the couple's assets to a revocable living trust. Harry is named as trustee and his daughter, Cindy, is named as successor trustee. The trust also names Carl as successor trustee if Cindy cannot serve for some reason. The sole beneficiaries of the trust during their lives will be Harry and Wilma, and, upon the death of the last spouse to die, any assets remaining in the trust will pass to Cindy and Carl equally.

Now, Harry can still manage the couple's property himself, but knows that if he should become incapacitated or die before Wilma, Cindy (and if not Cindy, Carl) will immediately take charge, paying the bills and providing Wilma with income until she dies. Harry also knows that when Wilma dies, Cindy and Carl will receive their inheritances without the delay and costs of probate.

Advantages

Avoids Guardianship

Typically, the grantor names himself or herself as the trustee, and someone the grantor trusts or a professional trustee is named as co-trustee or successor trustee. So, if the grantor should become unable to manage the trust assets for whatever reason, the co-trustee or successor trustee can immediately take over control and continue managing the assets with little or no lapse in between. This can be very important with certain types of assets that require frequent attention to maintain their value, such as rental property or a securities portfolio.

Avoids Probate

The grantor and the grantor's spouse are typically named as the sole beneficiaries of the trust during their lives, and at their deaths, any assets remaining in the trust pass to the grantor's named beneficiaries, usually children and grandchildren. If the grantor can and does transfer all of his or her assets in this way, having a will becomes unnecessary. Since assets passing by trust are not subject to probate as assets that pass by will are, distributions to beneficiaries can be made more quickly (and they are often needed quickly).

Further, bypassing probate will save the grantor's estate any costs that would have otherwise been incurred, such as filing fees and attorney's fees. And, finally, the grantor's family will be spared any burden that would be associated with the probate process, such as petitioning the court and organizing documents for filing.

Caution: Bypassing probate may not be an appropriate goal for some individuals. For example, smaller estates may qualify for an expedited probate process or be exempt from probate altogether. In some cases, the costs associated with a living trust may be greater than the costs associated with probate.

And, under certain circumstances, the court's oversight of the estate settlement during the probate process may be welcome (for example, when family conflict is involved).

Disadvantages

Does Not Save Taxes

Though a living trust is a separate legal entity, it is not a separate taxpayer during the grantor's lifetime. The grantor is considered the owner of the trust assets for tax purposes. All income and expenses generated by trust property flow through to the grantor and must be reported on the grantor's personal income tax return. However, upon the grantor's death, the trust becomes a separate taxpayer and different income tax rules apply.

Further, assets in the trust will be included in the grantor's gross estate, generally at their date of death value, for estate tax purposes. Therefore, a revocable living trust cannot be used as a way to minimize taxes.

Does Not Shelter Assets From Creditors

Generally, assets in a revocable trust are deemed to be owned by the grantor and are therefore reachable by creditors (although, in some states, the assets may not be reachable by Medicaid recovery after the look-back period expires).

Article Sourced by Broadridge Financial Solutions

David Cover, AIF®

Chief Wealth Management & Trust Officer

trust@frontierbank.com

|